Company: Square Enix

Languages: ENG/MULTI6

Original Size: 4.1 GB

Repack Size: from 1.2 GB [Selective Download]

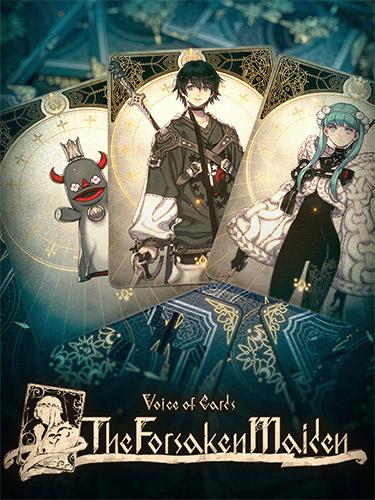

Voice of Cards: The Forsaken Maiden

Voice of Cards: The Forsaken Maiden brings the game indeed closer to the real thing with abecedarian gameplay advances and a new season of invention across every mode.

| Title | Voice of Cards: The Forsaken Maiden |

| Languages | RUS/ENG/MULTI18 |

| Genres | Card game, RPG, Fantasy, Japanese, Turn-based, 2D |

| Platform | PC/Windows |

| Publishers | Square Enix |

| Game Size | from 1.2 GB |

| Repack By | Fitgirl repacks |