Upcoming repacks

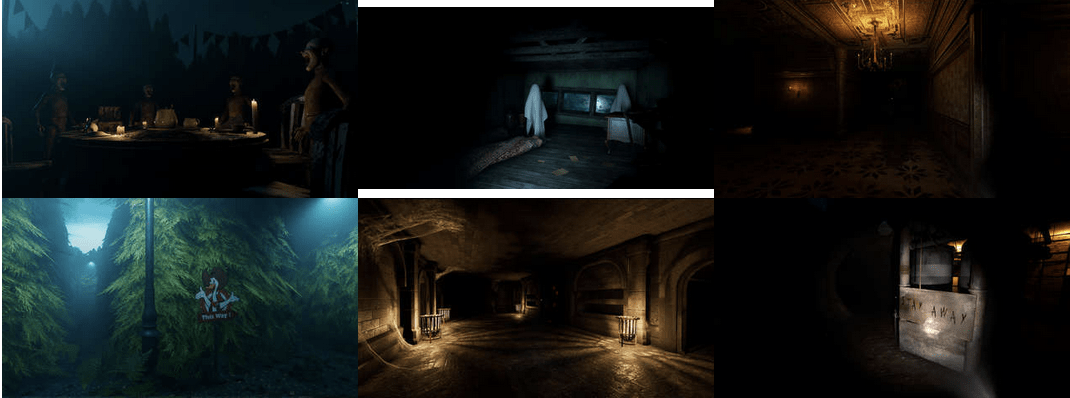

⇢ Nightmare House

⇢ Aquarist

⇢ Acolyte of the Altar

⇢ CD 2: Trap Master

⇢ DYSCHRONIA: Chronos Alternate – Dual Edition

⇢ My Life: Farm Vet

⇢ Terra Memoria

⇢ One Last Breath

⇢ The Magical Mixture Mill

⇢ War Tortoise

⇢ Open Roads

⇢ Project Hunt

⇢ Go Fight Fantastic

⇢ Boti: Byteland Overclocked – Deluxe Edition

⇢ Bulwark: Falconeer Chronicles

⇢ Outpost: Infinity Siege

⇢ Arma 3: Reaction Forces

⇢ Farmer’s Father: Save the Innocence

⇢ Gore Doctor

⇢ Bloody Ink

⇢ REAL ESTATE Simulator: FROM BUM TO MILLIONAIRE

Please consider donating to help me maintain this site and seedboxes for my repacks.

When kids DDoS my site, visit these trackers I publish my repacks on: 1337x.to, RuTor, Tapochek.net. I’m not dependent on the site for publishing my repacks and will never be – remember that.

DO NOT ASK FOR ANY PARTICULAR REPACKS IN COMMENTS. I NEVER SERVE REQUESTS

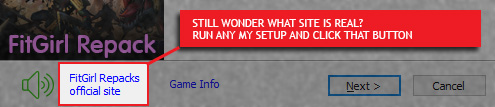

Special note about impostors

This site, fitgirl-repack.com is THE ONLY official site of my repacks. Every single FG repack installer has a link inside, which leads here.

ALL other “mirrors” (fitgirlrepacks.co, fitgirl-repacks.cc, fitgirl-repacks.site, etc.) are fakes, made to infect you with malware, show you tons of ads and get your money as donations. Don’t fall for them during your google sessions, just bookmark (CTRL+D) this site and come here directly.